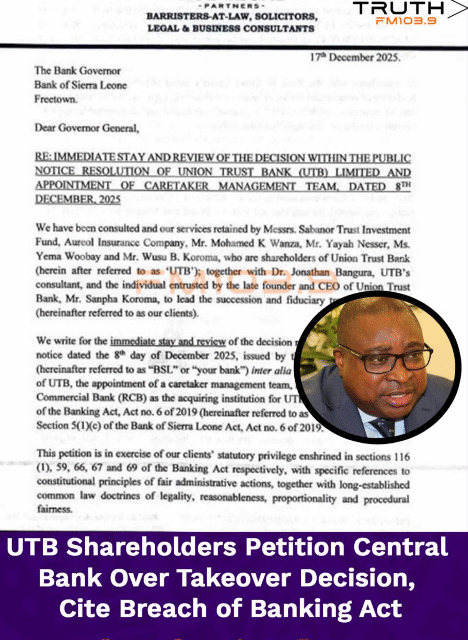

Freetown, 19th December 2025 —Shareholders of Union Trust Bank (UTB) have formally petitioned the Bank of Sierra Leone (BSL) to immediately “stay, recall and suspend” the regulator’s 8 December public notice that placed UTB under a caretaker management and approved Rokel Commercial Bank (RCB) as the acquiring institution.

The letter, submitted by ACE Legal Partners on behalf of major shareholders and consultant Dr. Jonathan Bangura, alleges statutory and constitutional breaches in the resolution process.

In the petition addressed to the Bank Governor, the shareholders claim BSL cut short the statutory window for UTB to submit its capital restoration plan. “By your letter dated the 14th day of November 2025, your bank directed that UTB should submit a capital restoration plan within 30 days, albeit that the said period falls short of the statutory timeframe of 45 days,” the letter states, referencing Section 69 of the Banking Act, 2019.

The petition further alleges the regulator did not even honour the shortened 30‑day period. “The receipt date of your letter (i.e., 18th day of November 2025) depicts that the 30-day period ought to have elapsed on the 18th day of December 2025… by the resolution date within your public notice, the total estimated period provided by your bank was approximately 20 days,” it reads.

Counsel argues that deviating from the Banking Act amounts to illegality under the Constitution. Citing Section 105 and Section 171(15), the letter asserts: “This constitution shall be the supreme law of Sierra Leone and any other law found to be inconsistent with any provision of this constitution shall, to the extent of the inconsistency, be void and of no effect… As such, any attempt by your bank to deviate from the Banking Act constitutes, beyond a mere statutory breach, a constitutional illegality.”

Who is petitioning and what they want- ACE Legal Partners say they act for Messrs. Sabanor Trust Investment Fund, Aureol Insurance Company, Mr. Mohamed Kwanza, Mr. Yayah Nesser, Ms. Yema Woobay and Mr. Wusu B. Koroma, shareholders of UTB, together with Dr. Jonathan Bangura, described as UTB’s consultant and “the individual entrusted by the late founder and CEO of Union Trust Bank, Mr. Sanpha Koroma, to lead the succession and fiduciary transition of UTB.”

Their requests are threefold:

Immediate stay of action: “That upon receipt of this letter, the decision emanating from Bank of Sierra Leone’s Public Notice of 8th December 2025 be stayed, recalled, and all receivership, resolution, and acquisition processes suspended pending a transparent and good-faith review.”

Urgent meeting: “That… you convene an urgent meeting involving Dr. Jonathan Bangura, other key stakeholders of UTB, the Director of Banking Supervision, and relevant senior officials, for the purpose of engaging substantively on the roadmap proposed herein.”

Approval to proceed with recapitalisation: “That our clients be granted the Bank’s approval to empower the proposed investor and management team to implement the recapitalisation and restructuring plan under the Bank’s direct supervisory oversight.”

The letter grounds its petition in Sections 116(1), 59, 66, 67 and 69 of the Banking Act, 2019, alongside constitutional principles of “fair administrative actions” and common law doctrines of “legality, reasonableness, proportionality and procedural fairness.” It also references Section 5(1)(c) of the Bank of Sierra Leone Act, 2019, which BSL cited in its public notice approving RCB as an acquirer.

Going forward, the petitioners say they are “anticipating” the Bank Governor’s “kind consideration” and seek a swift, transparent review of their recapitalisation proposal under BSL’s supervision. As of press time, the central bank had not publicly responded to the petition.

The outcome will test the balance between prudential oversight and due process in Sierra Leone’s banking sector, with implications for market confidence, depositor protection and investor participation in bank resolutions.

“Statutory instruments which regulate public entities (like your bank) have quasi‑constitutional effect, because they define the very scope of executive discretion,” the petition concludes. “Any attempt by your bank to deviate from the Banking Act… constitutes a constitutional illegality.”