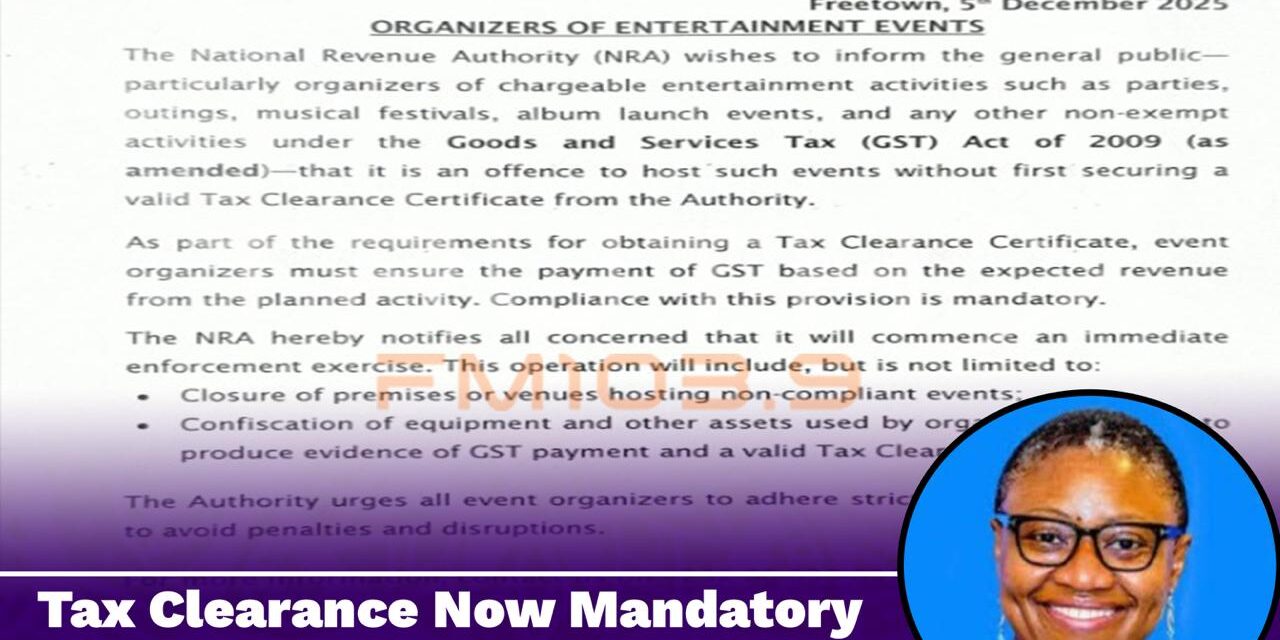

Freetown, 5th December, 2025 – The National Revenue Authority (NRA) has issued a stern warning to organizers of entertainment events, stressing that it is an offence to host chargeable activities without first obtaining a valid Tax Clearance Certificate.

The directive applies to parties, outings, musical festivals, album launches, and other non-exempt events under the Goods and Services Tax (GST) Act of 2009, as amended.

“As part of the requirements for obtaining a Tax Clearance Certificate, event organizers must ensure the payment of GST based on the expected revenue from the planned activity. Compliance with this provision is mandatory,” the Authority stated.

Officials confirmed that enforcement will begin immediately, with measures including the closure of venues hosting non-compliant events and confiscation of equipment or assets used by organizers who fail to produce evidence of GST payment and a valid certificate.

The NRA emphasized that adherence to tax obligations is crucial to avoid penalties and disruptions.

“The Authority urges all event organizers to adhere strictly to tax requirements to avoid penalties and disruptions,” the statement added.