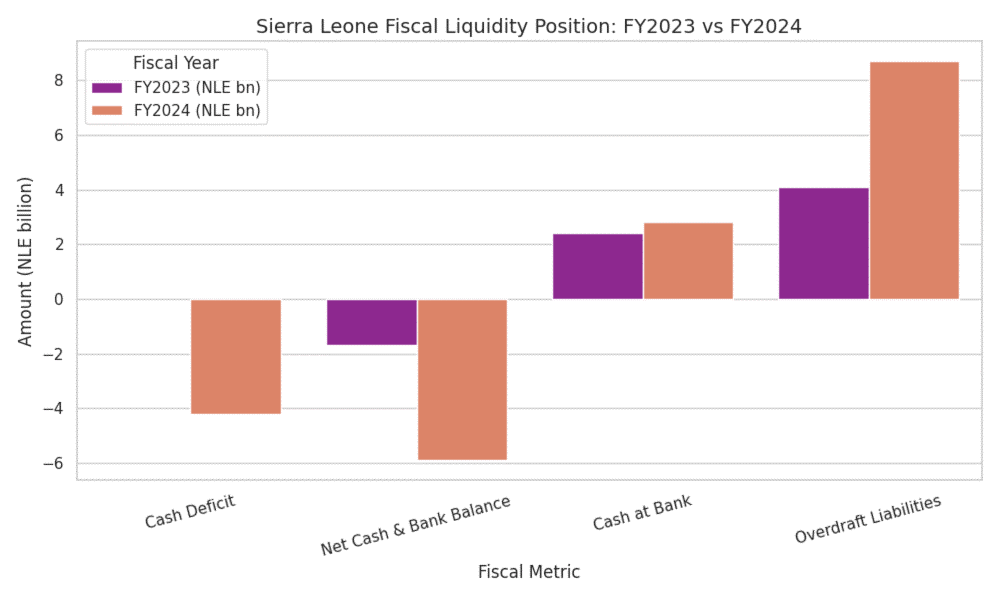

Freetown 25th August 2025- Sierra Leone’s fiscal liquidity deteriorated sharply in FY2024, with the government recording a cash deficit of NLE 4.2 billion, pushing its net cash and bank balance to a staggering negative NLE 5.9 billion, more than triple the previous year’s shortfall.

At the close of FY2023, the government’s cash and bank balances stood at negative NLE 1.68 billion. But by December 2024, that figure had ballooned to negative NLE 5.91 billion, driven by overspending and rising debt service obligations.

The breakdown reveals a modest increase in cash held at the bank from NLE 2.4 billion to NLE 2.8 billion but this was dwarfed by a steep rise in overdraft liabilities, which jumped from NLE 4.1 billion to NLE 8.7 billion. The net effect was a NLE 4.6 billion deterioration in the government’s liquidity position.

The cash deficit reflects the broader fiscal imbalance, where recurrent expenditures especially on wages and interest payments continue to outpace revenue inflows. With limited buffers and constrained access to concessional financing, the government appears increasingly reliant on overdraft facilities and short-term borrowing to meet its obligations.

Analysts warn that the growing cash deficit could undermine the government’s ability to fund essential services, delay payments to contractors, and erode public confidence in fiscal management.

“A negative cash balance of this magnitude is not just a number it’s a signal of stress,” said a senior economist. “Without urgent reforms in cash management and expenditure control, the government risks entering a liquidity trap.”

Calls continue to mount for the Ministry of Finance to publish a detailed cash flow strategy, improve arrears reporting, and prioritize development spending over recurrent excesses.