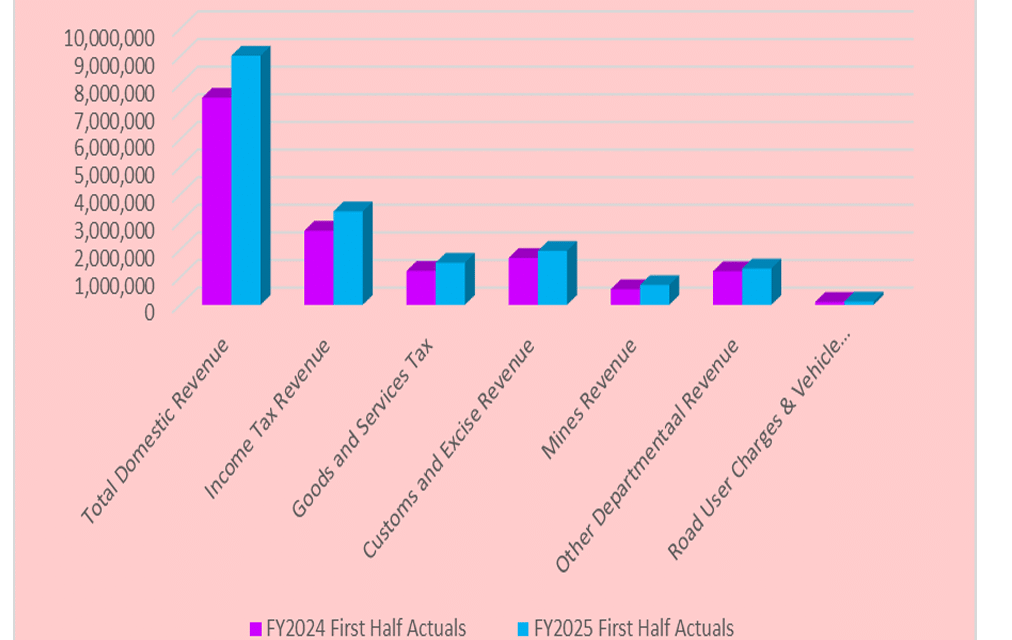

Freetown, 20th October 2025- Sierra Leone’s domestic revenue collection rose by 19.7% in the first half of FY2025, reaching NLe8.98 billion, up from NLe7.50 billion in the same period last year. The increase, which represents 4.6% of GDP, reflects the impact of new revenue measures rolled out by the government to boost fiscal performance. However, a shortfall in the first quarter has tempered the overall momentum.

The data, sourced from the National Revenue Authority (NRA), shows gains across key revenue categories including income tax, goods and services tax, customs and excise, and mining royalties. The comparative bar chart titled “Figure 3: First Half Domestic Revenue Budget and Actuals” illustrates year-on-year growth across nearly all streams, with notable improvements in customs and departmental collections.

The uptick in revenue follows the implementation of several administrative and policy reforms aimed at tightening compliance and expanding the tax base. These include enhanced monitoring, digital systems integration, and sector-specific audits.

Despite the progress, the Q1 shortfall signals challenges in sustaining collection targets amid global economic uncertainty and domestic structural constraints. Analysts say the government must maintain reform momentum and improve forecasting accuracy to avoid mid-year fiscal shocks.

With domestic revenue now accounting for a larger share of GDP, Sierra Leone’s fiscal strategy is shifting toward greater self-reliance. The challenge lies in balancing growth with resilience—ensuring that revenue gains are not only sustained but translated into tangible development outcomes.