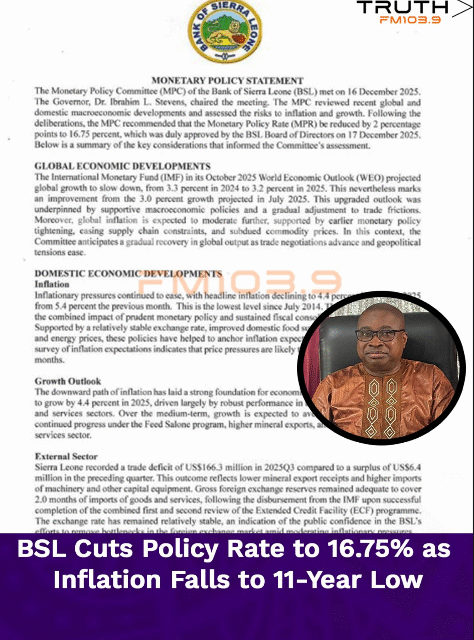

Freetown, 22nd December, 2025 – The Bank of Sierra Leone (BSL) has lowered its benchmark interest rate by two percentage points to 16.75 percent, following a sharp decline in inflation and signs of economic stability.

The decision was taken by the Monetary Policy Committee (MPC) at its meeting on December 16, chaired by Governor Dr. Ibrahim L. Stevens, and approved by the BSL Board of Directors on December 17.

The MPC also reduced the Standing Lending Facility Rate (SLFR) by one percentage point to 20.75 percent, and the Standing Deposit Facility Rate (SDFR) to 11.25 percent, effective December 19, 2025.

Headline inflation dropped to 4.4 percent in October 2025, down from 5.4 percent in September, the lowest level since July 2014. The MPC attributed the improvement to prudent monetary policy, fiscal consolidation, a stable exchange rate, improved domestic food supply, and subdued global food and energy prices. Surveys conducted by the BSL indicate that inflation expectations are likely to moderate further in the coming months.

With inflation easing, Sierra Leone’s economy is projected to expand by 4.4 percent in 2025, driven by agriculture, manufacturing, and services. Over the medium term, growth is expected to average 4.6 percent, supported by the government’s Feed Salone program, higher mineral exports, and continued expansion in services.

Despite the positive inflation trend, Sierra Leone recorded a US$166.3 million trade deficit in Q3 2025, compared to a surplus of US$6.4 million in the previous quarter. The shortfall was attributed to lower mineral export receipts and higher imports of machinery and capital equipment. Gross foreign exchange reserves remained adequate at 2.0 months of import cover, supported by IMF disbursements under the Extended Credit Facility. The exchange rate has remained relatively stable, reflecting public confidence in the BSL’s management of the foreign exchange market.

Government operations posted a higher overall deficit of NLe 2.0 billion in Q3 2025, compared to NLe 1.1 billion in the preceding quarter, due to weaker revenue collection and slightly higher expenditure. However, the primary balance remained in surplus, supported by ongoing fiscal consolidation measures, reduced discretionary spending, and improved debt management practices. Borrowing costs declined accordingly.

Reserve Money (RM) and Broad Money (M2) expanded in Q3 2025, driven by growth in Net Domestic Assets. Credit to the private sector moderated to 2.92 percent, down from 3.57 percent in Q2, as banks adopted a cautious lending approach amid tighter risk management.

The banking sector remains broadly stable and adequately capitalised, with key Financial Soundness Indicators within prudential limits. However, the MPC flagged rising non-performing loans, fraud risks, and cybersecurity threats as potential challenges. The BSL’s recent decision to place Union Trust Bank in resolution was noted as consistent with commitments under the IMF programme to safeguard financial stability.

The MPC said the easing stance is intended to support private sector investment and stimulate economic activity while keeping inflation expectations well anchored.

“With inflation at its lowest level in more than a decade, a stable exchange rate, and a resilient financial sector, carefully calibrated monetary policy easing is warranted,” the Committee stated.

The MPC pledged to remain vigilant and adjust policy as needed in response to domestic and global developments. The next meeting is scheduled for March 26, 2026.