By Sheriff Mahmud Ismail — Special Analysis Part One

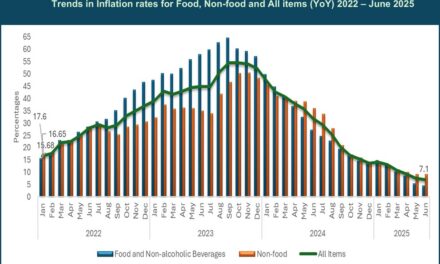

Freetown, 8th December 2025– When Sierra Leone’s government unveiled its 2026 national budget, it framed the document as a turning point, a promise of renewed agricultural productivity, social investment, and a pathway out of chronic economic strain. But beneath the optimistic language lies a familiar tension: a country attempting to engineer growth atop a fiscal structure that shows signs of deep fragility.

Independent economists warn that the budget rests on uncertain assumptions, narrow revenue space, and an expanding burden of recurrent expenditure that continues to crowd out development priorities. The result is a plan that aspires to transformation but struggles under the weight of structural constraints.

A Budget That Survives Calm Waters, but Not a Storm

The most sobering assessment emerges from a series of fiscal stress tests conducted by analysts, which paint a picture of a budget highly vulnerable to even moderate economic shocks. A mere 10 percent shortfall in domestic revenue, a realistic scenario in a year of weakening global demand and unstable currency markets, would widen the fiscal deficit by more than 50 percent. A delay in donor disbursements, on which Sierra Leone remains heavily dependent, would push the deficit even higher.

In the worst-case scenario, combining revenue decline, donor delays, rising interest rates, and emergency spending needs, the deficit would swell to more than 7 percent of GDP a level economists describe as fiscally dangerous for an already debt-distressed nation.

“This is textbook fiscal fragility,” one local economist noted, pointing to the country’s recklessly low reserves, rising debt rollover risks, and absence of meaningful fiscal buffers. “The budget survives only under perfect conditions. Economies rarely behave that politely.”

A Government of Ambition, Without the Allocations to Match

Central to the budget’s political messaging is Feed Salone, the administration’s flagship agricultural modernization program. But analysts reviewing the spending plan say the numbers tell a more tempered story.

Although agriculture is highlighted as the government’s top priority, the budget does not state what share of total spending the sector receives, nor does it outline the ratio of capital to recurrent expenditure. In practice, domestic allocations to agriculture remain mid-tier, trailing sectors like security, energy subsidies, and public administration.

The disconnect reflects a broader pattern. Education and health sectors routinely described as cornerstones of the country’s human-capital agenda are presented without consolidated allocation figures. In a region where governments are expected to allocate 15–20 percent of total spending to education and at least 5 percent to health, the absence of clarity is striking.

“This is the heart of the credibility challenge,” said a Sierra Leonean Economist who reviewed the document. “The rhetoric is flurry, but the fiscal detail is missing. A modern budget must show its math.”

The High Cost of Recurrent Spending

One of the most consequential features of the 2026 budget is the scale of recurrent expenditure wages, interest payments, administrative costs, and subsidies which together exceed NLe 16.5 billion. This figure represents more than 70 percent of projected domestic revenue, leaving limited room for capital investment in sectors that drive long-term growth.

For many Sierra Leoneans, these figures translate into an uncomfortable reality: funds spent on consumption today come at the expense of schools, hospitals, roads, and other infrastructure tomorrow.

Economists calculate that the wage bill alone could fund dozens of fully equipped scores of district hospitals or construct scores of secondary schools. Instead, capital spending remains thin, fragmented, and vulnerable to mid-year cuts when revenue projections fall short.

“This is the recurring dilemma,” says a former Ministry of Finance official. “The government is forced to borrow simply to stay afloat. Development becomes discretionary.”

A Tax Regime Under Strain

To finance its obligations, the government has broadened the tax base and introduced new compliance measures, touting these reforms as essential for fiscal sustainability. But business owners and market associations counter that the tax system, though technically ambitious, has become increasingly difficult to navigate.

Traders complain of higher levies at ports, manufacturers cite rising excise burdens, and small businesses fear they are being squeezed into the formal tax net without corresponding improvements in public services.

The result is what several analysts describe as a paradox: a tax regime intended to expand revenue risks shrinking the very economic activity on which revenue depends.

“This is a classic economic constraint,” said a policy analyst at a regional think tank. “When taxation begins to erode productivity rather than enable it, the system becomes self-defeating.”

Debt, Donors, and the Lost Space for Growth

Sierra Leone’s debt service obligations, forecast at NLe 8.6 billion for 2026, now rival the scale of its largest social-sector needs. Combined with the wage bill, they leave little discretionary space for development programs. The government insists it will pursue fiscal consolidation and enhanced domestic revenue to correct these imbalances, but international financial institutions caution that the country’s economy remains highly vulnerable.

Recent IMF assessments point to persistent structural weaknesses: limited export diversification, dependence on food and fuel imports, and exposure to global commodity fluctuations. The World Bank has echoed these concerns, urging the government to prioritize capital investments with clear productivity returns.

Yet the 2026 budget, shaped heavily by immediate fiscal pressures, falls short of that prescription.

Everyday Lives, Rising Pressures

For ordinary citizens, these macroeconomic dynamics manifest in tangible hardship: rising prices, shrinking household budgets, and limited employment opportunities. In marketplaces across Freetown, traders describe a cost-of-living environment where survival, not profitability, has become the primary goal.

Transport operators cite the compounded effect of fuel volatility and new taxes. Small manufacturers struggle to obtain credit as government borrowing crowds out private lending. And families face rising school costs amid stagnant incomes.

These pressures form the backdrop against which the 2026 budget will be judged not just by Parliament, but by a population increasingly weary of promises unfulfilled.

A Plan in Search of Credibility

Ultimately, the 2026 budget is a document of vain ambition intent constrained by harsh economic realities. It is a plan that identifies the right priorities on paper agriculture, human capital, infrastructure but struggles to fund them consistently or transparently. It acknowledges the vulnerabilities of the global economy but provides limited domestic resilience to withstand them.

What emerges is a portrait of a government caught between vision and viability, framing a future it does not yet possess the fiscal capacity to deliver.

In the words of one analyst, “This is a budget built on hope, but hope is not a strategy especially in an economy this fragile.”