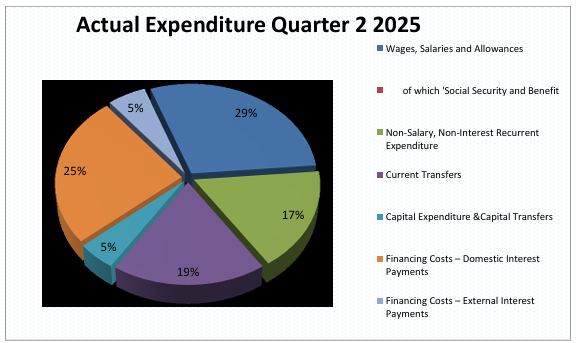

Freetown, 1st September 2025– The government’s actual expenditure for the second quarter of 2025 reveals a continued emphasis on public sector wages and capital investment, with notable allocations toward social security and infrastructure. The data, presented in a pie chart titled “Actual Expenditure Quarter 2 2025”, offers insight into fiscal priorities and the balancing act between recurrent costs and long-term development.

According to the breakdown, Wages, Salaries, and Allowances accounted for the largest share of spending at 29% of total expenditure. Within this category, Social Security and Benefits alone consumed 17%, underscoring the government’s commitment to maintaining public sector employment and supporting vulnerable populations.

The second-largest slice of the budget went to Capital Expenditure and Capital Transfers, which made up 25% of total spending. This signals a strong push toward infrastructure development, public works, and long-term investment projects aimed at stimulating economic growth and improving service delivery.

Meanwhile, Non-Salary, Non-Interest Recurrent Expenditure stood at 19%, covering operational costs such as utilities, supplies, and administrative services across ministries and departments. This figure reflects the ongoing cost of running government institutions beyond payroll obligations.

Current Transfers, which include subsidies and grants to agencies and local councils, received 5%, matching the allocation for Domestic Interest Payments—a sign of the government’s effort to manage its debt obligations while maintaining intergovernmental support.

Notably, External Interest Payments accounted for just 1%, suggesting that the bulk of Sierra Leone’s debt servicing remains domestic, or that external creditors have offered favorable terms or deferred payments during the quarter.

The expenditure profile paints a picture of a government focused on maintaining its workforce, investing in infrastructure, and managing debt with caution. However, the relatively low allocation to external interest payments may also reflect limited access to international credit markets or a shift toward concessional financing.

As Sierra Leone continues to navigate post-pandemic recovery and economic reform, the balance between recurrent spending and capital investment will remain critical. Analysts will be watching closely in the coming quarters to see whether this trend holds and whether the investments made today translate into measurable improvements in public services, employment, and economic resilience.

For citizens, the numbers offer a glimpse into how their taxes are being spent and whether the government’s priorities align with the country’s pressing needs.