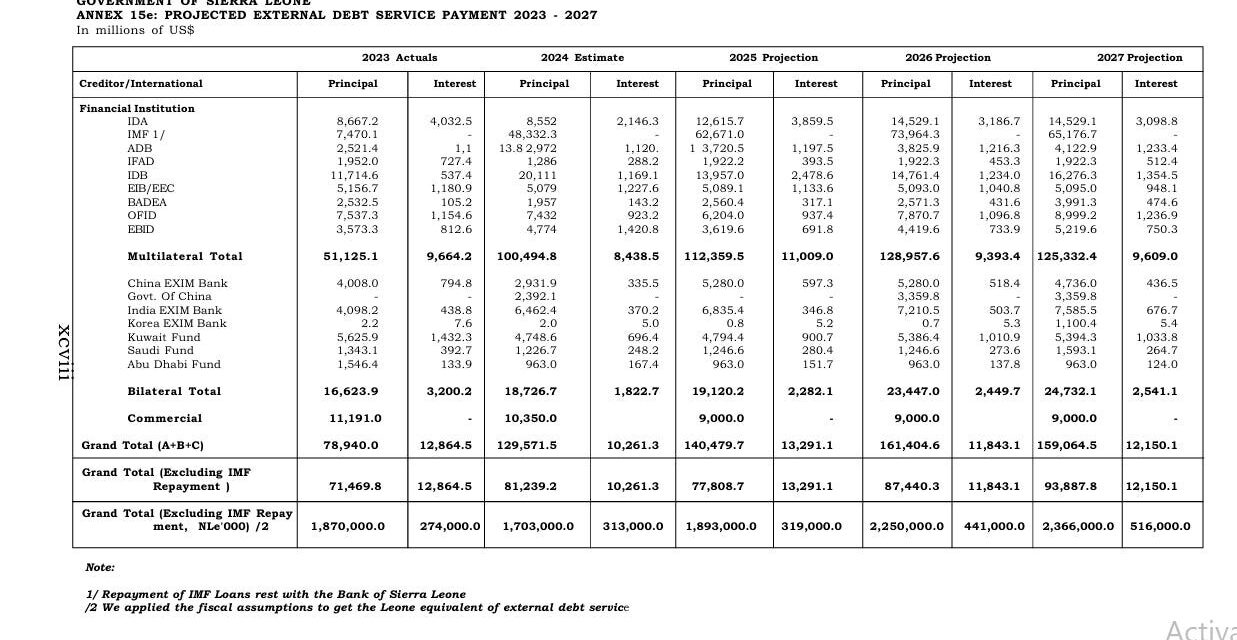

Freetown, September 8th 2025- Sierra Leone’s external debt service obligations are projected to grow steadily over the coming years, raising critical questions about the sustainability of the country’s debt and its ability to fund essential public services. According to projections for 2023–2027, the country faces escalating debt repayments across multilateral, bilateral, and commercial creditors.

In 2023, Sierra Leone’s total external debt service payments amounted to US$91.8 million, including US$78.9 million in principal and US$12.9 million in interest payments. By 2025, this figure is expected to rise significantly, reaching US$153.8 million in total payments (US$140.5 million principal and US$13.3 million interest). This marks an increase of approximately 67% from 2023.

The trend continues, with debt service obligations projected to peak at US$171.3 million in 2027. The increase reflects both the repayment of loans and rising interest costs, particularly from multilateral lenders, which account for the majority of the debt.

Multilateral creditors such as the International Development Association (IDA), International Monetary Fund (IMF), and African Development Bank (ADB) represent a substantial portion of Sierra Leone’s debt obligations. For instance, repayments to the IDA alone are set to rise from US$12.6 million in 2025 to US$14.6 million by 2027. Similarly, IMF debt service obligations remain high, with payments totalling US$73.9 million in 2025 and increasing to US$65.2 million in 2026.

Bilateral creditors, including China EXIM Bank, Kuwait Fund, and Saudi Fund, are also significant contributors to Sierra Leone’s debt service. Bilateral payments are projected to grow from US$18.7 million in 2024 to US$24.7 million in 2027. Meanwhile, commercial debt remains stable, with a flat repayment of US$9 million annually from 2025 to 2027.

The rising debt service payments are mainly attributed to three factors: increased borrowing for development projects, exchange rate depreciation and interest rate pressures.

The growing debt service payments will consume a larger share of Sierra Leone’s fiscal budget, potentially diverting funds from critical areas like healthcare, education, and social protection.

With over US$140 million earmarked for debt servicing in 2025, the government faces tough decisions on balancing debt obligations and meeting domestic development needs.

The rising debt burden poses risks to the country’s financial stability, especially if economic growth and revenue generation fail to keep pace with repayment obligations.

While the growing debt service burden is concerning, it also reflects investments in infrastructure and human capital. To manage the debt sustainably, Sierra Leone can consider enhancing domestic revenue mobilization, exploring debt restructuring options and expanding export-oriented sectors.

Sierra Leone’s projected debt service payments highlight the delicate balance between leveraging debt for development and ensuring long-term fiscal sustainability. While the government’s efforts to finance critical projects are commendable, effective debt management and robust economic policies will be crucial to avoid future financial strain.