Freetown 25th August 2025- Sierra Leone’s fiscal position took a sharp downturn in FY2024, with the government recording a staggering cash deficit of NLE 4.2 billion, culminating in a negative cash balance of NLE 5.9 billion by year-end. This marks a troubling shift in the country’s financial trajectory, raising urgent questions about budget discipline, debt sustainability, and the future of public service delivery.

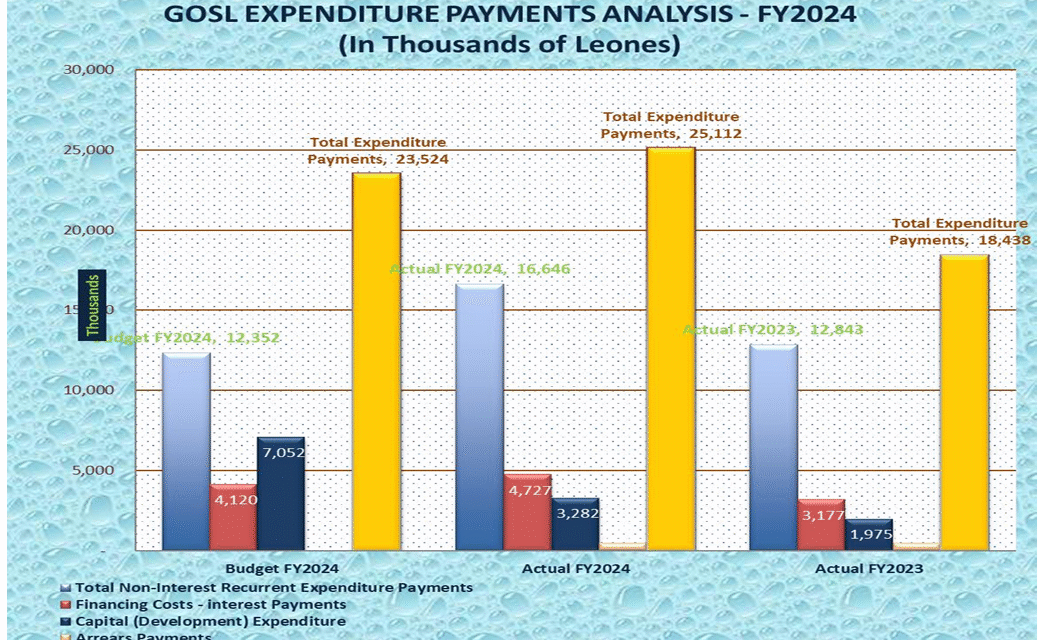

According to official expenditure data from the Ministry of Finance, the government’s actual spending far exceeded its budgeted allocations across key categories: Government spending in FY2024 revealed a stark departure from budgeted expectations. Non-interest recurrent payments, covering salaries, goods, and services, soared to NLE 16.6 billion, overshooting the budgeted NLE 12.4 billion by a massive NLE 4.3 billion. Interest payments also climbed beyond projections, reaching NLE 4.7 billion, up NLE 607 million from the allocated amount, reflecting the growing burden of debt servicing.

In contrast, capital expenditure, funds earmarked for development projects, was dramatically curtailed. The government spent just NLE 3.3 billion on capital investments, falling short of the NLE 7.1 billion budget by NLE 3.8 billion. This sharp reduction signals a troubling shift away from long-term infrastructure and growth priorities.

Overall, total expenditure payments amounted to NLE 25.1 billion, exceeding the approved budget of NLE 23.5 billion by NLE 1.6 billion. The imbalance between recurrent overspending and underinvestment in development underscores the fiscal strain driving Sierra Leone’s deepening cash deficit. While recurrent spending ballooned, particularly on wages, goods, and services, capital investment was slashed by over 53%, signaling a pivot away from long-term development in favor of short-term operational costs.

Interest payments rose by 17% compared to FY2023, reflecting growing debt obligations. Meanwhile, arrears payments remain opaque, with no clear reporting in the latest fiscal summary raising concerns about hidden liabilities and delayed payments to contractors and suppliers.

The widening deficit and negative cash balance suggest the government may be relying heavily on domestic borrowing or overdraft facilities to stay afloat. This could crowd out private sector credit, fuel inflationary pressures, and undermine investor confidence.

Economists warn that without urgent fiscal consolidation, Sierra Leone risks entering a cycle of unsustainable debt and deteriorating public services. The sharp cut in development spending could stall infrastructure projects, education reforms and healthcare expansion, undermining the country’s long-term growth prospects.

As the Ministry of Finance prepares its mid-year review, civil society groups and policy analysts are calling for greater transparency in budget execution, improved cash management, and a renewed focus on development priorities.