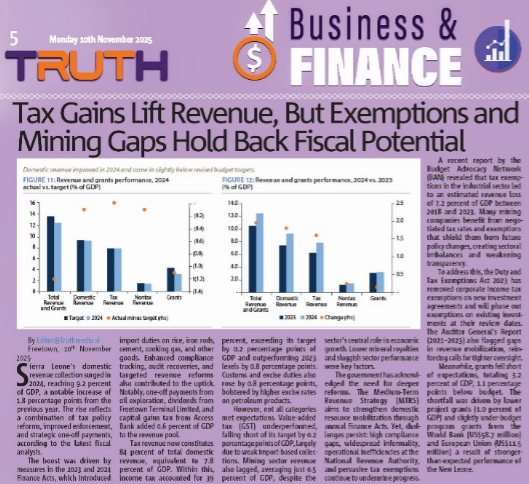

Freetown, 10th November 2025- Sierra Leone’s domestic revenue collection surged in 2024, reaching 9.2 percent of GDP, a notable increase of 1.8 percentage points from the previous year. The rise reflects a combination of tax policy reforms, improved enforcement, and strategic one-off payments, according to the latest fiscal analysis.

The boost was driven by measures in the 2023 and 2024 Finance Acts, which introduced import duties on rice, iron rods, cement, cooking gas, and other goods. Enhanced compliance tracking, audit recoveries, and targeted revenue reforms also contributed to the uptick. Notably, one-off payments from oil exploration, dividends from Freetown Terminal Limited, and capital gains tax from Access Bank added 0.6 percent of GDP to the revenue pool.

Tax revenue now constitutes 84 percent of total domestic revenue, equivalent to 7.8 percent of GDP. Within this, income tax accounted for 39 percent, exceeding its target by 0.2 percentage points of GDP and outperforming 2023 levels by 0.8 percentage points. Customs and excise duties also rose by 0.8 percentage points, bolstered by higher excise rates on petroleum products.

However, not all categories met expectations. Value-added tax (GST) underperformed, falling short of its target by 0.2 percentage points of GDP, largely due to weak import-based collections. Mining sector revenue also lagged, averaging just 0.5 percent of GDP, despite the sector’s central role in economic growth. Lower mineral royalties and sluggish sector performance were key factors.

The government has acknowledged the need for deeper reforms. The Medium-Term Revenue Strategy (MTRS) aims to strengthen domestic resource mobilization through annual Finance Acts. Yet, challenges persist: high compliance gaps, widespread informality, operational inefficiencies at the National Revenue Authority, and pervasive tax exemptions continue to undermine progress.

A recent report by the Budget Advocacy Network (BAN) revealed that tax exemptions in the industrial sector led to an estimated revenue loss of 7.2 percent of GDP between 2018 and 2023. Many mining companies benefit from negotiated tax rates and exemptions that shield them from future policy changes, creating sectoral imbalances and weakening transparency.

To address this, the Duty and Tax Exemptions Act 2023 has removed corporate income tax exemptions on new investment agreements and will phase out exemptions on existing investments at their review dates. The Auditor General’s Report (2021–2023) also flagged gaps in revenue mobilization, reinforcing calls for tighter oversight.

Meanwhile, grants fell short of expectations, totaling 3.2 percent of GDP, 1.1 percentage points below budget. The shortfall was driven by lower project grants (1.0 percent of GDP) and slightly under-budget program grants from the World Bank (US$58.7 million) and European Union (US$11.5 million) a result of stronger-than-expected performance of the New Leone.