Freetown, 2nd October 2025- Sierra Leone’s industrial sector failed to pay an estimated Nle 248 million in taxes in 2024, a figure that has sparked urgent calls for reform in the country’s tax exemption regime. The revelation comes from the Budget Advocacy Network (BAN), whose recent report exposes systemic gaps in compliance and oversight.

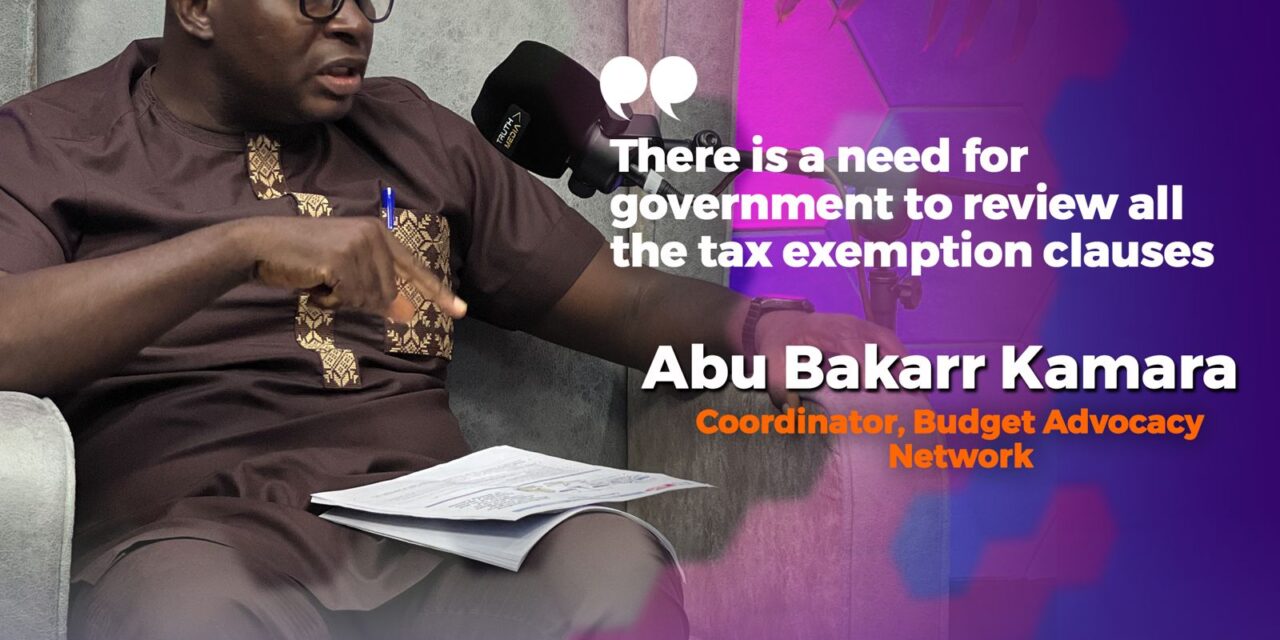

Abu Bakarr Kamara, BAN’s National Coordinator, described the situation as a “fiscal red flag,” noting that 73% of total tax arrears in 2024 were owed by entities benefiting from exemptions. “These companies are not just exempt from certain taxes, they’re failing to pay the ones they’re still legally obligated to,” Kamara told Truth Media.

The report, titled Tax Exemptions in Sierra Leone’s Industry Sector: Who Wins, Who Loses, reveals that while the industrial sector contributes just 12% to domestic revenue, it accounts for a staggering 60% of revenue forgone through exemptions. The mining subsector, which dominates industrial GDP, is the largest beneficiary.

Kamara warned of a phenomenon he calls “eating twice”, where companies enjoy exemptions on select taxes but neglect their remaining obligations. This practice undermines national compliance rates, with Corporate Income Tax compliance at just 55.4% and Goods and Services Tax at 60.1%.

The consequences are stark. The NLe 248 million in unpaid taxes exceeds the combined national budgets for school fee subsidies, tertiary hospital services, and reproductive health programs. BAN is urging the government to tie exemptions to measurable development outcomes and require exempted entities to file and pay non-exempt taxes before receiving further benefits.

“This is not just about revenue, it’s about fairness, accountability, and the integrity of our fiscal system,” Kamara emphasized.