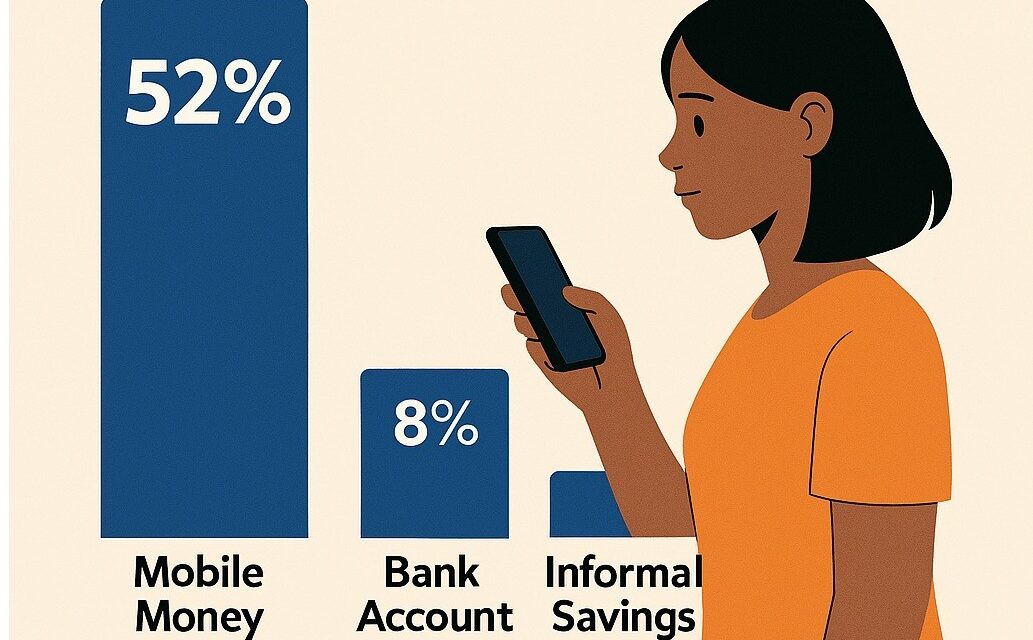

Freetown, 1st September 2025– In Sierra Leone’s fast-growing informal economy, young people are building businesses and managing money, but largely without banks. According to the 2025 Status of Youth Report, 52% of youth rely on mobile money for their financial transactions, while only 8% have a formal bank account. Another 21% use informal savings systems like ‘Osusu’, revealing a financial ecosystem driven by necessity, not inclusion.

The data, drawn from a nationally representative survey of 2,420 youth, shows that mobile money has become the financial lifeline for Sierra Leone’s young entrepreneurs. Yet, even this digital solution faces serious infrastructure challenges. 42% of respondents cite lack of electricity as the biggest barrier to mobile money usage especially in the Northwest (60%) and Western Urban (59%) regions. Without reliable power, the promise of mobile finance remains fragile.

Meanwhile, the formal banking sector continues to miss the mark. 23% of youth say bank branches are too far, 22% struggle with complex account opening requirements, and 16% report being unable to access loans. These figures point to a system that excludes the very demographic driving Sierra Leone’s economic hustle.

Nearly 50% of youth are engaged in non-farm enterprises, making them a critical force in the country’s commerce and retail sectors. But their businesses are overwhelmingly informal and unregistered, limiting access to credit, legal protections, and growth opportunities. The report highlights stark disparities: 28.4% of youth with formal education are involved in business, compared to just 6.6% of those without schooling. Similarly, 41% of employed youth run businesses, versus 33.3% of unemployed youth.

Despite their economic activity, young entrepreneurs face steep barriers. Limited access to capital, lack of business skills, and restricted market opportunities are the top challenges. Most operate as sole proprietors, often without licenses or formal records, leaving them outside the reach of government support and financial institutions.

Policy experts recommend expanding microfinance and start-up loan schemes tailored to youth, scaling entrepreneurship training programs to build business acumen, providing mentorship and networking platforms to support growth and incentivizing formalization through access to credit, grants, and legal support.

In the financial sector, stakeholders are called to simplify account opening processes, develop youth-friendly financial products, and invest in digital financial literacy. Addressing infrastructure gaps, especially electricity, is critical to ensuring mobile money can serve as a reliable tool for economic empowerment.

The survey, conducted through in-person interviews in respondents’ preferred languages, carries a margin of error of ±1.95% at a 95% confidence level, and reflects a gender-balanced sample. Its findings offer a clear message: Sierra Leone’s youth are entrepreneurial, digitally active and economically engaged. But, they are navigating a system that is still catching up.